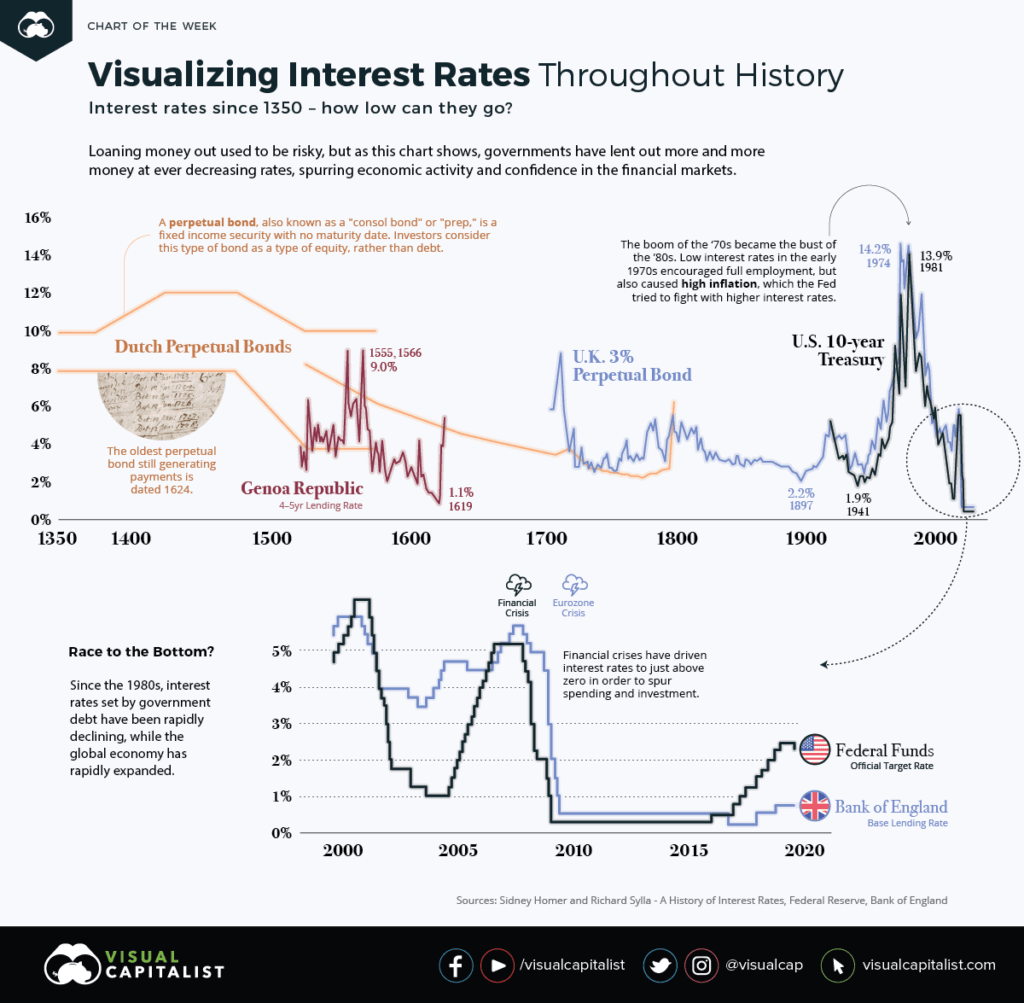

Today, we live in a low-loan fee condition, where the expense of obtaining for governments and foundations is lower than the chronicled normal. It is anything but difficult to see that loan fees are at generational lows, however did you realize that they are additionally at 670-year lows?

The current week’s diagram traces the financing costs joined to credits going back to the 1350s. Investigate the decreasing history of the expense of obligation—cash has never been less expensive for governments to get than it is today.

The Birth of an Investing Class

Exchange carried numerous smart thoughts to Europe, while helping prod the Renaissance and the advancement of the cash economy.

Key European ports and exchanging countries, for example, the Republic of Genoa or the Netherlands during the Renaissance time frame, help give a decent sign of the expense of getting in the early history of loan fees.

The Republic of Genoa: 4-multi year Lending Rate

Genoa turned into a lesser partner of the Spanish Empire, with Genovese brokers financing a large number of the Spanish crown’s remote undertakings.

Genovese investors furnished the Spanish illustrious family with credit and normal pay. The Spanish crown likewise changed over questionable shipments of New World silver into capital for further adventures through financiers in Genoa.

Dutch Perpetual Bonds

An unending bond is a bond with no development date. Speculators can regard this kind of bond as a value, not as obligation. Backers pay a coupon on unending bonds always, and don’t need to recover the head—much like the profit from a blue-chip organization.

By 1640, there was such a great amount of trust in Holland’s open obligation, that it made the renegotiating of extraordinary obligation with a much lower financing cost of 5% conceivable.

Dutch commonplace and metropolitan borrowers gave three sorts of obligation:

Promissory notes (Obligatiën): Short-term obligation, as conveyor bonds, that was promptly debatable

Redeemable bonds (Losrenten): Paid a yearly enthusiasm to the holder, whose name showed up in an open obligation record until the credit was paid off

Life annuities (Lijfrenten): Paid enthusiasm during the life of the purchaser, where passing drops the head

Not at all like different nations where private financiers gave open obligation, Holland managed planned bondholders. They gave numerous obligations of little coupons that pulled in little savers, as skilled workers and frequently ladies.

Rule Britannia: British Consols

In 1752, the British government changed over the entirety of its exceptional obligation into one security, the Consolidated 3.5% Annuities, so as to diminish the loan cost it paid. After five years, the yearly loan cost on the stock dropped to 3%, modifying the stock as Consolidated 3% Annuities.

The coupon rate stayed at 3% until 1888, when the money serve changed over the Consolidated 3% Annuities, alongside Reduced 3% Annuities (1752) and New 3% Annuities (1855), into another bond─the 2.75% Consolidated Stock. The loan fee was additionally diminished to 2.5% in 1903.

Loan fees quickly returned up in 1927 when Winston Churchill gave another administration stock, the 4% Consols, as an incomplete renegotiating of WWI war bonds.

American Ascendancy: The U.S. Treasury Notes

The United States Congress passed a demonstration in 1870 approving three separate consol issues with recovery benefits following 10, 15, and 30 years. This was the start of what got known as Treasury Bills, the cutting edge benchmark for financing costs.

The Great Inflation of the 1970s

During the 1970s, the worldwide securities exchange was a wreck. Over a 18-month time frame, the market lost 40% of its worth. For near 10 years, barely any individuals needed to put resources into open markets. Financial development was frail, bringing about twofold digit joblessness rates.

The low intrigue approaches of the Federal Reserve in the mid ’70s empowered full work, yet in addition caused high swelling. Under new authority, the national bank would later invert its strategies, raising loan costs to 20% with an end goal to reset private enterprise and support speculation.

Looking Forward: Cheap Money

From that point forward, financing costs set by government obligation have been quickly declining, while the worldwide economy has quickly extended. Further, money related emergencies have driven financing costs to simply over zero so as to prod spending and venture.

Unmistakably the curve of loaning twists towards consistently diminishing financing costs, however how low would they be able to go?

NEWS RESOURCE: https://www.visualcapitalist.com/the-history-of-interest-rates-over-670-years/